Description

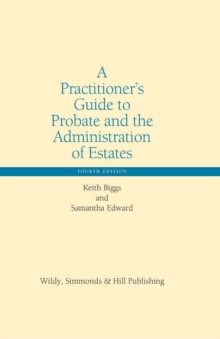

| Product ID: | 9780854902361 |

| Product Form: | Hardback |

| Country of Manufacture: | GB |

| Series: | Wildy Practitioner Guide Series |

| Title: | A Practitioner’s Guide to Probate and the Administration of Estates |

| Authors: | Author: Keith Biggs, Samantha Edward |

| Page Count: | 600 |

| Subjects: | Law: wills, probate, succession, inheritance, Wills & probate / Succession |

| Description: | The fourth edition of A Practitioner’s Guide to Probate and the Administration of Estates is a practical and comprehensive guide to all forms of non-contentious probate applications, completion of Inheritance Tax Accounts and the administration of estates. The fourth edition of A Practitioner’s Guide to Probate and the Administration of Estates is a practical and comprehensive guide to all forms of non-contentious probate applications, completion of Inheritance Tax Accounts and the administration of estates. The book is packed with hints and tips and an accompanying CD-ROM contains a comprehensive set of precedent forms, enabling practitioners to adapt precedents for their own use. The authors provide careful explanations of every step in the procedure for winding up the estate of a deceased person, from taking initial instructions to the final distribution of the estate and closing the file. The book opens with advice on meeting the client and taking proper instructions; moving on to tracking down the assets and liabilities which comprise the estate; completing inheritance tax forms and obtaining any available reliefs and allowances; questions concerning wills and intestacies; applying to the probate registries; discretionary orders; obtaining grants of representation; collecting in the paying debts and liabilities; identifying the beneficiaries and paying the legacies; finalising the tax situation; and distributing the residue of the estate. This new edition has been completely revised with practice and procedure brought up-to-date, |

| Imprint Name: | Wildy, Simmonds and Hill Publishing |

| Publisher Name: | Wildy, Simmonds and Hill Publishing |

| Country of Publication: | GB |

| Publishing Date: | 2018-06-29 |